Cross Border Forum- Giving Up Your Green Card

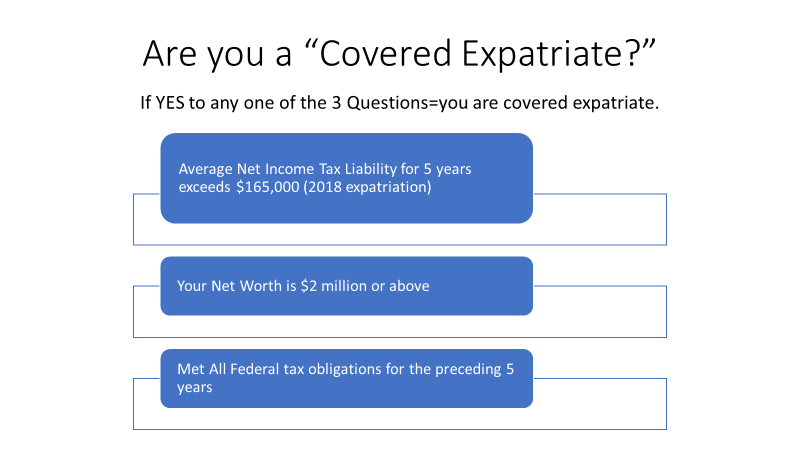

Are you a covered expatriate?

If you are considering giving up your green card (i.e. permanent residency status), you must know if you are in a special category called “covered expatriate.” Please see the diagram below. Please note that the rules apply to those who have held a green card for 8 years or more out of the last 15 years (“Long Term Resident”.)

There are serious consequences if you are a covered expatriate.

- Your 401(k) distribution is subject to 30% withholding tax. I think that this is also true to the insurance annuity product.

- Your IRA account is considered liquidated on the date of your expatriation. This means that you must include the proceed in your final income tax returns. The entire amount will be taxed even before you receive the amount.

Also, you are required to fill out the form W-8CE. You are required to submit this form to your investment institution (who pays your benefits) before the expatriation date. On this form, you are giving a waiver of any treaty benefits that may reduce the withholding amount.

For instance, in the Japan US tax treaty’s section 17, pension payments are to be taxed in the resident country. This means that if you go back to Japan and receive pension payments from the US, only Japan (i.e. resident country) can tax pension amount. Also, under the section 17, there is no withholding tax requirements (of course, there is none.)

Once you file W-8 CE, you cannot take advantage of your income tax treaty!

So, if you qualify for the definition of a covered expatriate, you will need a careful planning so that you are not going to be classified as a covered expatriate. One way to avoid your net worth requirement is to give gifts to your spouse or children to reduce your net worth. Generally, the limit is $11.4 million a year. That will probably help you to reduce your net income tax liability, too. Finally, you must be compliant with the federal tax laws. (This goes out saying.)

This article only covers the key points of your interest and does not cover all the rules and regulations. If you consider giving up your permanent residency, please contact CDH for further planning. We will find the best option for you.