Supports Cross Border Professionals and Families

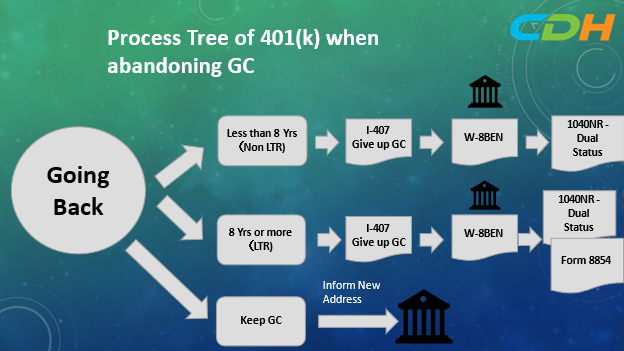

You should read this article if you have a green card and wonder what to do with your US 401(k) in your home country. If you do not need to renew your green card, you should abandon your green card by filing an I-407 to USCIS as soon as you arrive in your home country. Once you file your I-407, you also should submit W-8BEN to the US financial institution that holds your 401(k). Effectively, you inform them that you are no longer a US resident for tax purposes. Depending on your country, taxation of future distribution from your 401(k) will differ in tax treatment. In general, if you live in a country where the U.S. has a tax treaty, the withholding rate would benefit you. For instance, the institution will not withhold US taxes from your distribution if you live in Japan.

After you abandon your green card by filing I-407, next year, you file your final U.S. tax returns (Form 1040 NR-Dual Status). W-8BEN must usually be renewed every three years.

If you hold your green card for eight years or more, you are a long-term resident (LTR) under U.S. tax rules. When calculating the number of years, one day of Green card holding in a year counts as one year. The 401(k) process is similar to those whose holding does not reach eight years. The only difference is that you must file Form 8854 with your 1040 NR-Dual Status.

Another word of caution for LTR is this. You must file W-8CE on a timely basis to your financial institution if you become a covered expatriate. A covered expatriate is not in the scope of this article. You become a covered expatriate if you cannot declare your U.S. federal tax compliance for five years or if your net worldwide asset is at least two million dollars a day before you abandon your green card. You may face additional taxes from the U.S. government. This is called exit tax.

You must inform your financial institution of your new address if you intend to maintain your green card while living in a foreign country.

Before you go back to your home country, I suggest that you make the following inquiries to your financial institutions to ensure your smooth transition:

- Can I maintain my 401(k) account even if I move to other country?

- Can I maintain my 401(k) account if I abandon my permanent residency?

- Can I request the distribution wired to my account in a foreign country?

- How does your financial institution send the funds via check, ACH, or international wire?

- How can I instruct the Plan to distribute the funds when I am overseas?

- How can I authenticate myself overseas?

Depending on the responses you get, you can plan. I also caution you that you must be subject to a ten percent early withdrawal penalty if you are under 59.5 years old.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]