Supports Cross Border Professionals and Families

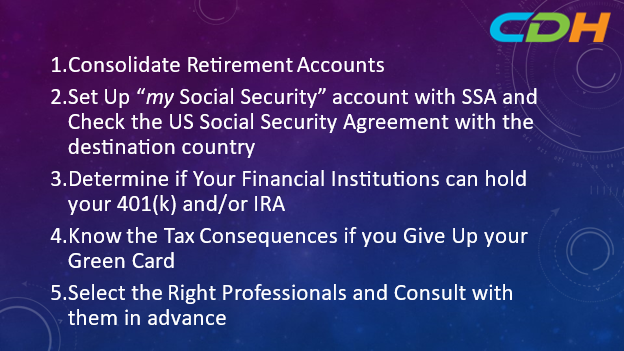

- Consolidate Retirement Accounts

I am not recommending you to rollover your 401(k) to one IRA account. I understand many individuals have multiple 401(k)s or IRA accounts and regular investment accounts at various financial institutions. Managing and monitoring fewer accounts from overseas would be easier. A simple advice, but I believe that it is essential. When you go overseas, permanently or tentatively, you must exert energy to understand the local country’s customs and regulations. It would be wise to organize your US accounts before you leave. Thus, you have time to get accustomed to the local rules.

At the same time, as I explain later in this article, U.S. financial institutions can alter their policies of holding investments for green card holders at any time. For this reason, it may be wiser to have at least two financial institutions holding your funds to hedge this risk.

- Set up a “my Social Security” account before you leave and check the US Social Security Agreement with the destination country!

Google “my Social Security” and set up your account before you leave. You cannot set up this social security account after your permanent address becomes overseas. This account provides personalizing tools about your social security. You must set up a two-step verification like many online user accounts do. Try not to use your US cell phone to do the verification because you may stop using the US cell phone when going overseas.

The second action is to research if the U.S. has a social security agreement with your destination country. If you leave the U.S., the Social Security Administration’s default action is to stop the benefits after the sixth calendar month in a row that you are outside of the country. You can continue to receive the benefits if your destination country has a social security agreement that guarantees continuous payments of SS benefits. You can also search the “Payments Abroad Screening Tool” on the SSA site and find out if you can receive the benefits. There are approximately 30 countries that have agreements with the U.S.

- Determine if Your Financial Institutions can hold your 401(k) and IRA

Many financial institutions do not hold green card holders’ (US non-residents’ ) retirement accounts due to the high compliance costs and associated risks. This is more so for IRAs. There may be a few exceptions. I hear a few names of so-called “friendly” financial institutions for US non-residents. I want you to remember the two essential knowledge. The first is that each institution has its unique policy. And, often, it takes effort to find out precisely what it is. Second, such an institution can change its policy without warning you at any time.

Spend enough time to discover the truth about your financial institution, and you should be ready when it says it changes the policy. To hedge this risk, you may want to have plan B ready anytime. One may want to keep relationships with two financial institutions.

- Know the Tax Consequences if you Give Up your Green Card

You cannot usually maintain your green card if you permanently move to another country from the U.S. You may retain your green card for a certain period if your stay in another country is tentative and short. You may need to abandon your green card in the future. There are U.S. tax consequences for giving up your green card.

You may defer the U.S. taxes on your 401(k) if you become a “Covered Expatriate.” There are three tests to determine if you are a covered expatriate. I will not describe the rules here. However, you may not defer the U.S. taxes on your IRA if you are a covered expatriate. In other words, there is a striking difference in the U.S. taxations to 401(k) and IRA, and you should be aware of the difference before you return the green card and become a covered expatriate. If you do not become a covered expatriate, there should be no tax differences.

- Select the Right Professionals and Consult with them in Advance

There are three critical criteria.

- Experience in Cross-Border transactions – you need to judge if the person has enough experience in US matters. An honest individual usually says that he does not have experience. A not-so-honest individual tries to convince you that he has enough experience. You should be able to tell the difference.

- Consultant has general knowledge of your destination country or an excellent network in the destination country – One consultant possibly can’t know the details of the U.S. and the other country’s rules. However, general knowledge about another country would help. In addition, a good advisor usually has an excellent network where he can ask or refer you to the right advisor in another country.

- Willingness to refer if the advisor determines he is not the right fit – A good advisor should say, “No, I am not the right person for you.” In the professional world, this is called the competency criteria. A professional should be competent enough to assist his client. If he determines that he does not have skills or knowledge, he should decline the engagement.

With these criteria, you should invest your time in identifying the right person for you.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, Facebook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]