Second Draw Payroll Protection Program Loans and First Draw Forgiveness

Businesses continue to face unprecedented economic hardship due to the Coronavirus (COVID-19) outbreak. To assist, the Coronavirus Aid, Relief and Economic Security (CARES) Act has provided initial relief resources to those in need. For many companies, this was in the form of a First Draw Payroll Protection Program (PPP) loan, or the First Draw PPP Loan. As the virus progressed, the second round of financial relief, referred to as the Second Draw PPP Loan, was passed in the final days of 2020 in the Economic Aid to Hard-Hit Small business, Nonprofits, and Venues Act (the Economic Aid Act).

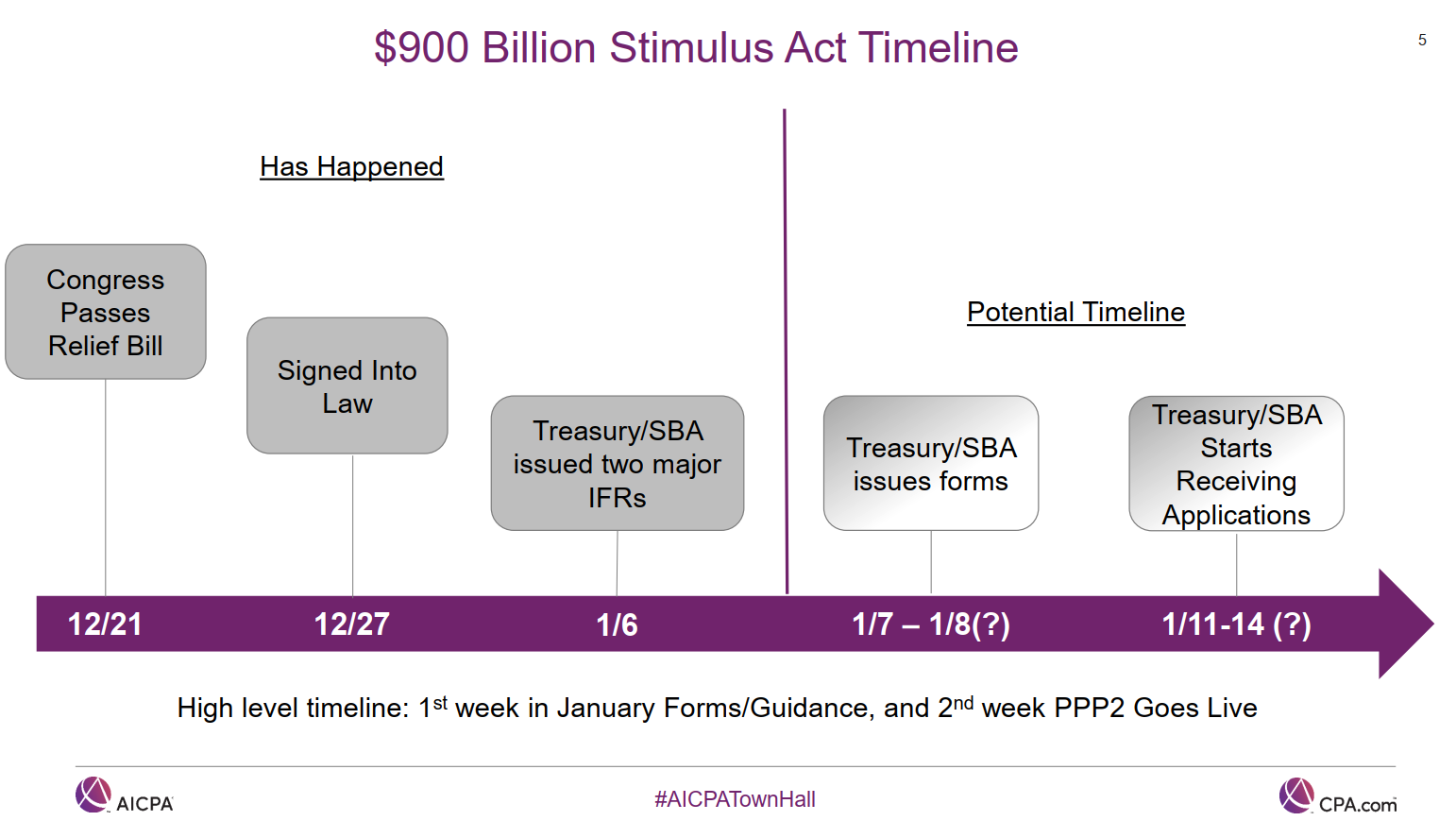

Source: AICPA

This update focuses on the Second Draw PPP Loan considerations for businesses and the remaining steps related to First Draw PPP Loans, including applying for the debt’s forgiveness. This should assist Companies in considering questions such as:

- Do I qualify for a Second Draw PPP Loan and what are the requirements?

- Have I completed everything related to the First Draw PPP Loan, including potential loan forgiveness?

- What immediate actions should I take to manage my potential relief?

Second Draw PPP Loan Requirements for Businesses

- Eligible applicants, the type defined similarly to the First Round of PPP, are business concerns that were eligible and received First Draw PPP Loans with 300 or fewer employees.

- Applicants with multiple locations that are operated as a separate legal business are limited to 300 employees per applicant.

- The First Draw PPP Loan received is required to be used by the date of distribution of the Second Draw PPP Loan.

- Second Draw PPP Loans cannot exceed $2 Million (First Draw limit was $10 million).

- Meet the “gross receipts reduction test” that compares gross receipts in 2020 to 2019, either on a quarterly or annual basis, requiring a 25% reduction in at least one-quarter calculations vary for businesses not operating for a portion of 2019,

- Payroll multipliers are similar to the First Draw calculation of 2.5 x average payroll costs (based on payroll costs one year before loan or calendar year 2019, with calculations for specific Borrowers (defined by NAICS codes) using 3.5 x average payroll costs.

- There are specific requirements in the Second Draw PPP Loans that are similar to the First Draw, such as the rules on affiliations, use of funds, and many other borrower requirements and restrictions.

- The procedures and requirements for Forgiveness of Second Draw PPP Loans are similar to the First Draw, with the additional requirements of documentation of the gross receipts test required for all forgiveness applications.

- The window for Second Draw PPP Loans is limited to the first quarter of 2021 with the availability ending on March 31, 2021.

First Draw PPP Loan Forgiveness Application

Companies can still apply for forgiveness of First Draw PPP Loans, which includes completing and submitting the application and other documentation to the SBA lending institution of loan origination.

- Application for forgiveness does not impact the Second Draw Loans’ requirements other than all of the proceeds of the First Draw need to be used.

How CDH Can Help with Next Steps

- Perform a rapid assessment of the Second Draw PPP Loan considerations for your business, including requirements and next steps like gathering required financial information, payroll cost analysis and gross receipts test information listed above.

- Monitor the SBA site for an update on the approved application’s timing and your SBA lending institution.

For assistance in performing analysis or preparing your documentation surrounding First or Second Draw PPP Loans, or any relief assistance, please contact the CDH Covid Relief Response team at [email protected].