Supports Cross Border Professionals and Families

Many foreigners leave Japan after living there for some years. They discovered that Japan’s gifting and inheritance tax regime is substantially more punitive than those in their home countries. In particular, this is true for U.S. citizens. In 2023, the unified credit for U.S. citizens is a whopping $12.96 million. Very few people in the U.S. pay taxes for gifting and inheritance. Although many love Japan for various reasons such as security, food, cost of living, and medical care level/costs, they give up living in Japan and return to the U.S.

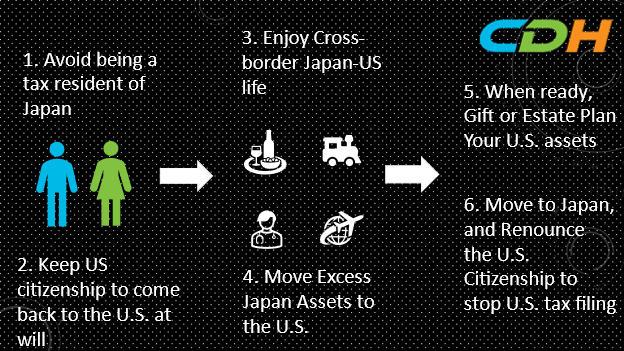

In this article, I present one tax-efficient pattern of US-Japan cross-border life.

The criteria to become a tax resident in Japan is similar to the U.S. domicile determination. There is no bright-line testing like the substantial presence test of the U.S. It is based on facts and circumstances. Once you become a tax resident, Japan tax on your worldwide income and worldwide assets in the gifting and inheritance tax regime (there are always exceptions based on circumstances.)

Therefore, it is critical that you hire a competent tax accountant (“Zeirishi”) in Japan to have them monitor your situation. There may be new changes in Japan’s gift and inheritance law this year. In 2021, Japan eased the tax rules for specific residency types of foreigners. I recommend you not to try to understand the rules by yourself. You are risking too much by doing so.

Secondly, regardless you are a tax resident of Japan, Japan taxes domestic assets in gifts and inheritance. For your information, the U.S. has a tax treaty with Japan about gifts and inheritance. But, regarding the Japanese taxes, the treaty’s benefits are minimal. Thus, you can move your Japanese assets to the U.S. to avoid being taxed in Japan.

You should keep the above two points in mind while maintaining your cross-border lifestyle.

However, all of us get older. Our lifestyles change to accommodate diminishing physical capabilities. Everyone will reach the stage where you can no longer keep the cross-border lifestyle. If you foresee that the change is coming, you can make a move.

If you have extra assets in the U.S., you can dispose of them by gifting or estate planning. You will no longer own substantial assets that make you fear Japan’s taxation. Then, you can move to Japan permanently to pick up the tax residency and give up your U.S. citizenship if you do not mind. You will be relieved of the U.S. tax filing obligations by giving up your U.S. citizenship. In addition, you no longer need to use the Unified Credit of $12.96 million.

When giving up your U.S. citizenship, you must be aware of a potential U.S. exit tax; however, if you lower the level of your assets before the renouncement, the risk of being taxed is also lower. However, I advise you to comply with the U.S. tax rules because there is a compliance test when giving up your U.S. citizenship. Of course, it is always important to be tax compliant.

Many Americans do not abandon citizenship because of patriotism, trust in the American government, and America’s ideals. I am not giving you my opinion on whether you should give up your citizenship. I am only describing the U.S. tax consequences of citizenship renunciations.

I hope I have shed some light on your planning for a future cross-border lifestyle. Consult competent Japanese and U.S. tax experts separately to deal with the two countries complex tax rules. Being a true expert in the two tax regimes is virtually impossible. Each country’s laws are constantly changing, too.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]