Supports Cross Border Professionals and Families

First and foremost, you must know the striking characteristics of US gift taxes. The person who makes a gift (donor) is liable for gift taxes. Many countries, such as Japan, levy taxes on the person who receives the gift (donee). Therefore, if you plan to become a donor, you must know the rules.

The definition of domicile is as follows: The country a person treats as their permanent home or lives in and has a substantial connection with.

Then, let’s turn to what the IRS says. It says: “Domicile is defined as living within a country with no definite intent of leaving. Determining domicile for estate and gift tax purposes is fact specific. Once a noncitizen establishes the United States as their domicile, they remain a United States domiciliary until a new domicile is established. If there is doubt as to the location of domicile, there is a rebuttable presumption that the decedent was domiciled within the country where they resided.”

I think the keyword is “fact specific.” There is no bright-line rule to determine if you are a US domiciliary.

Let’s get to the practical applications discussion.

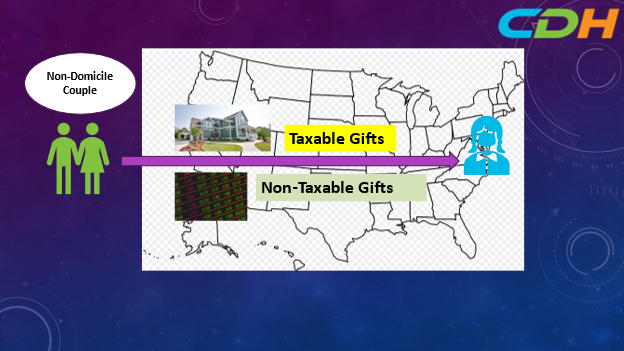

You can use the unified credit system if you are a US domiciliary. In 2023, the amount of available unified credit is $12.92 million. As a result, most of the U.S. population does not pay federal gift and estate taxes. On the other hand, you cannot use unified credit if you are not a US domiciliary. You must pay gift taxes if the gift is in the U.S. This is called U.S. situs property. The exclusion is intangible assets (intangible assets) such as mutual funds and stocks.)

Let’s assume that a couple turns out to be non-domiciliary. Maybe, they are just about to return to their home country permanently and retire there. Let’s take that right before their departure; they want to gift their CA residential home and stock holdings. Because they are non-domiciliary, they must pay US gift taxes to the real property, a tangible property, but not the stocks because stocks are intangible assets.

If they are US domiciliary, they can utilize the unified credit, and if we assume that they have sufficient unified credit left, they pay no taxes.

Briefly, I want to touch upon US gift tax calculations. The fair market value, less the annual gift exclusion (2023’s exclusion is $17,000.), is subject to the gift tax. The rate structure is a marginal tax bracket system that is the same as the individual income tax system. The rate starts from 18%, and the highest tax bracket is 40%. The rate is not low.

Finally, let’s briefly touch on where US tax authorities will review to determine whether you are a U.S. domiciliary.

- Statement of Intent (in visa applications, tax returns, will, etc.)

- Length of US residence

- Green card status

- Style of living in the US and abroad

- Ties to the former country

- Country of residence

- Location of business interests

- Places where club and church affiliations, voting registration, and driver’s licenses are maintained.

- Location of family members

Determining whether you are a US domiciliary is based on facts and circumstances. You would need professional support to form your tax position. The IRS can challenge the status. Of course, if you become a US citizen, you are permanently U.S. domiciliary.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]