Supports Cross Border Professionals and Families

With today’s remote work environment, I am sure many employers receive inquiries about whether their employees can work remotely overseas. I want to explain how to minimize tax risks in such a situation.

The first risk is called Permanent Establishment (“PE”). Suppose you have your employee or an agent (may be an independent contractor) working in a local country other than the U.S. Such a local government may consider your employee’s presence as a “fixed place of business.” In other words, such a country’s tax authority may think your company is doing business on its turf. It could be an entity form or a branch of a US corporation. A fixed place of business in this context in the tax world is called Permanent Establishment (“PE”).

You may wonder about the consequences of being a PE in a local country. First, your company probably must register by obtaining a foreign identification number. Once you get an identification number, your company must start paying various taxes, such as income and payroll taxes. I am sure an average employer wants to avoid such a situation. It is similar to registering in a new state when you expand beyond your state. Registration and paying taxes are burdens to the management.

Many factors come into play in determining PE status. Does your employee maintain an office? Do you keep inventory? Does your employee or even an agent have the authority to sign contracts or purchase goods?

To avoid PE designation, an employer must look at two sources. One is, if any, a US income tax treaty with a local country. If there is one, usually Article 5 defines PE in the accord. The second source must be the local country’s tax rules about PE. Each country may have its definition of PE. Once you understand the requirements to be PE, you can devise a plan to avoid the situation.

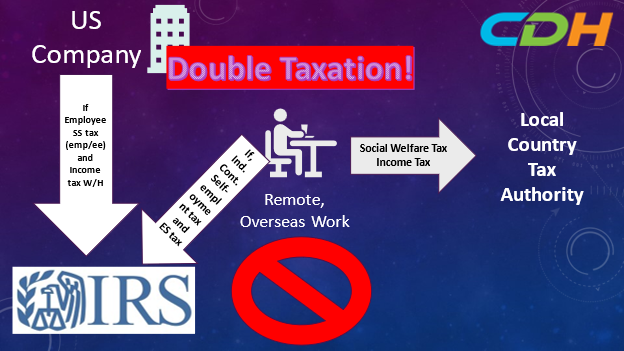

Even if you can avoid the PE issue, double taxation is another issue. The issue could arise in income and social welfare taxes for your employee or an agent. I am limiting my discussion here to US citizens or Green Card holders. They will be US tax residents no matter where they work. They must report worldwide income to the IRS. In addition, if they are classified as your employee, an employer must withhold U.S. social security, Medicare, and income taxes and submit the withheld taxes to the IRS. That is an essential duty of a U.S. employer. If they are classified as independent contractors, they, as their responsibilities, must pay self-employment taxes and, if necessary, quarterly estimated taxes to the IRS. Self-employment taxes means social security and Medicare taxes for self-employed individuals.

I will not discuss the distinction between employee and independent contractor in this article as it is beyond the scope of this article.

Depending on the duration and style of living of your employee in a local country, they will become subject to local country’s taxes. If that happens, they must pay the local country’s social welfare and income taxes. There are exceptions. I heard that England, Thailand, and Guatemala do not levy social welfare taxes on workers employed by foreign corporations. I have not verified this. But it is worth mentioning this.

What can the employer do?

For income taxes, there are two tax mechanisms that your employee may use. The first is called Foreign Earned Income Exclusion. In 2023, one can exclude earned income up to $120,000 from taxable wages in 1040 if one meets certain conditions. The second is the foreign tax credit system, where you can minimize double taxation by taking credit in Form 1040. Please be aware that there is no guarantee that the entire double taxation can be eliminated. As an employer, you should assist your employee in researching these options.

One should investigate the US social security agreement with a local country, if any, for social welfare taxes. The U.S. has social security agreements with about thirty countries. For example, Japan and the US have a deal, and if one can obtain a Certificate of Coverage, one can avoid double taxation of the social welfare taxes. One also should review local rules surrounding the public pension payment requirements. As an employer, you should also assist your employee in finding the best solution.

With careful planning and research, you can minimize the tax risks of your employee working remotely overseas.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]