Supports Cross Border Professionals and Families

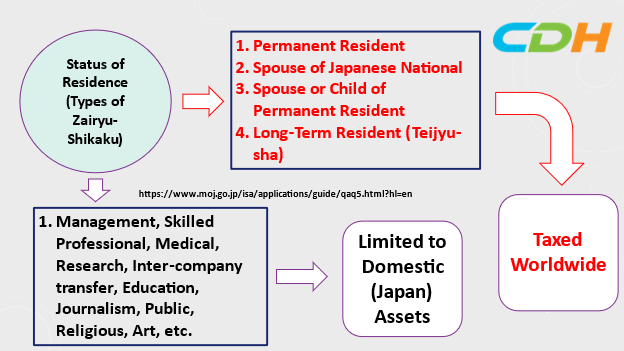

In the 2021 tax reform, the Japanese government gave breaks to foreigners in gift and inheritance tax. They wanted to promote the employment of highly-skilled foreign talent in Japan. In this article, I highlight the difference in your residence status in Japan (“Zairyu Shikaku”) affects taxation in Japan.

Bad news first. If you move to Japan in one of the following categories, the Japanese government taxes your worldwide assets in gifts and inheritance. They are listed in red in the above diagram. There are four categories. Please refer to the website of the Immigration Services Agency of Japan. ( https://www.moj.go.jp/isa/applications/guide/qaq5.html?hl=en )

Case 1:

You move to Japan with your Japanese spouse to permanently retire in Japan. You keep sizable assets in the U.S., such as 401(k) or brokerage accounts. If you gift those assets to others or pass away and leave those assets to your heirs, the Japanese government taxes you with substantially low exclusion amounts. The annual gift exclusion is 1,100,000 Yen (less than $10,000); no unified credit exists. The basic inheritance tax exclusion is 30,000,000 Yen (less than $300,000). You can avoid paying U.S. taxes because of the generous unified credit and your US domicile status. However, you cannot avoid paying substantial taxes (up to 55%) to the Japanese government.

Reform:

Japan needs a more qualified labor force. The latest news is that hotels and inns in Japan need more workers, and even after Covid-19, they cannot run their operations at a full scale. Many foreigners leave Japan for other countries to avoid being taxed. Many feel that the system is unfair.

Before the reform, there was a restriction on the total period of domicile in Japan. It was ten years. The Japanese government did not tax worldwide assets if your total period of having domiciled in Japan is ten years or less within the fifteen years before an event occurs causing the inheritance/gift.

The new rule is that a non-Japanese national with specific resident status resides in Japan when an event occurs causing the inheritance/gift (regardless of the residence period.)

Case 2:

If you are in the status of residence described above in lower black boxes, the Japanese government cannot tax your non-Japanese gifting or inheritance. In other words, your US assets are safe from Japanese taxation, assuming the US government continues the high unified credit tax rules.

Conclusion:

Before you obtain your residency status (“Zairyu Shikaku”), consider this rule and research if you can obtain the favorable status to avoid the tax penalty of living in Japan.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]