News & Blogs

CDH NewsUnlocking Efficiency and Transparency: Why Non-Profits are Embracing Sage Intacct

May 20, 2025 | Uncategorized

In an era where financial stewardship and operational transparency are paramount, non-profit organizations face increasing pressure to optimize their resources while maintaining rigorous accountability. Enter Sage Intacct, a cloud-based financial management solution...

Tax Day 2025: How CDH Supports Your Success—Today and Every Day

Apr 14, 2025 | Uncategorized

As Tax Day 2025 arrives, many individuals and businesses are breathing a collective sigh of relief—and at CDH, we’re right there with you. Our team of dedicated professionals has been working closely with clients to ensure deadlines are met, filings are accurate, and...

Say Goodbye to Manual Bank Transactions! Master Sage Intacct’s Bank Import Assistant

Feb 20, 2025 | Uncategorized

Importing and reconciling bank transactions can be a tedious process—unless you’re using Sage Intacct’s Bank Transaction Assistant. This powerful tool enables businesses to import, match, and reconcile transactions efficiently, reducing manual workload and improving...

Simplify Bank Transaction Imports with Sage Intacct’s Bank Transaction Assistant

Feb 20, 2025 | Uncategorized

Managing bank transactions efficiently is crucial for businesses seeking financial accuracy and streamlined reconciliation. Sage Intacct’s Bank Transaction Assistant offers a powerful solution to simplify this process, saving time and minimizing manual effort. Why Use...

How Outsourcing Transforms Financial Operations for Property Managers and Hotel Owners

Feb 17, 2025 | Uncategorized

Cost savings are often the first benefit property managers and hotel owners associate with outsourcing accounting services. While reducing expenses is a clear advantage, the true impact of outsourcing goes far beyond balancing budgets. In the best cases, outsourcing...

Solving Accounting Talent Challenges for Property Managers and Hotel Owners

Feb 4, 2025 | Uncategorized

In the property management and hospitality industries, managing finances effectively is crucial for maintaining profitability, ensuring compliance, and delivering top-tier guest experiences. However, property managers and hotel owners now face a growing...

Curious About Transitioning from Microsoft Dynamics GP to the Cloud?

Dec 16, 2024 | Uncategorized

Microsoft has announced it will end product support and updates for Dynamics GP (Great Plains) on September 30, 2029, with security patches ceasing on April 30, 2031. For organizations relying on Dynamics GP, this is the ideal time to explore modern cloud-based ERP...

Dual Citizenship Dilemma: Filing U.S. Taxes from Abroad

Jul 25, 2024 | Uncategorized

In today's increasingly internationalized society, many people hold dual citizenship. However, there are unique tax complications associated with dual citizenship. In particular, U.S.-born dual nationals often face complex tax issues because they are required to...

Real Estate Investing to Realize Financial Goals

Jun 11, 2021 | Blog, Tax Services, Uncategorized

Investing in real estate is one of the most beneficial modes for generating wealth and is known to be the best performing asset in modern times. Owning real estate creates opportunities to generate cash flow, create avenues for effective wealth building and...

Accounting for Financial Instruments

Jun 11, 2021 | Blog, Tax Services, Uncategorized

The accounting treatment of investments is a complex area to understand, but the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”) in January 2016 in order to reduce the complexity of the original standard for financial...

Impairment During the Pandemic

Jun 21, 2021 | Uncategorized

By Andrea Krueger, Principal, CDH, P.C. Are you worried about the long-term impacts of the current pandemic on your assets? Many companies are struggling to assess the various uncertainties in our current economic climate. According to the Wall Street Journal, the...

Child Tax Credit Update for 2021

Jul 6, 2021 | Uncategorized

Recently, there were changes made to the child tax credit that will benefit many taxpayers. As part of the American Rescue Plan Act that was enacted in March 2021, the child tax credit: Amount has increased for certain taxpayers Is fully refundable (meaning you can...

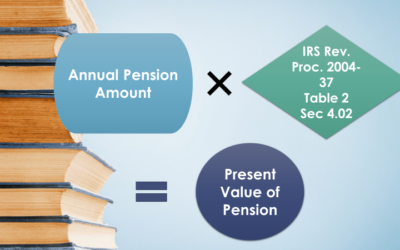

Valuation of defined benefit pension plan in Exit Tax

Jul 8, 2021 | Uncategorized

Supporting cross-border life A test called the Net Worth Test for exit taxes determines whether a global asset in your name exceeds $2 million or not as of the day before the permanent residence abandonment. Those with defined benefit plans or annuities must...

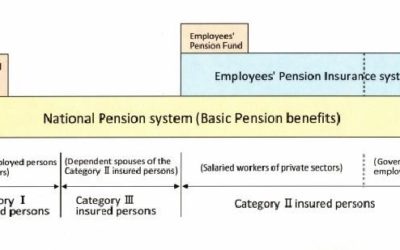

If you obtain U.S. citizenship, what will happen to your pensions? Three Must-Know Knowledge-the US and the Japan pension systems

Jul 19, 2021 | Uncategorized

I will explain three indispensable pension knowledge of Japan and the United States that I would like you to know when obtaining U.S. citizenship from permanent residency status. In the U.S., not knowing certain critical information can quickly put you in a very disadvantageous position.

You Can Receive Survivor’s Benefits from Your Deceased Japanese Spouse under the Japan Pension

Jul 19, 2021 | Uncategorized

If your Japanese spouse is receiving the pension payment from Japan, you may be able to receive the survivor’s benefits when your spouse passes away. The essential function of the system is very similar to the U.S. social security’s survivor’s benefits. A surviving spouse can receive a pension in the U.S. or Japan. There is no discrimination based on the nationalities of the spouse. Here is the writing by the Japan Pension Service:

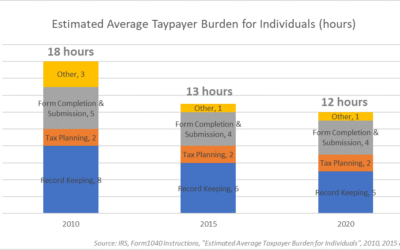

How much time do you spend preparing your tax returns?

Jul 21, 2021 | Uncategorized

Annual tax returns. How are you filing them? Do you purchase tax preparation software, use filing agency services, or use an accounting firm?

Accounting for Leases: Accounting Standards Codification (“ASC”) 842

Jul 22, 2021 | Uncategorized

Although the lease standards have been delayed multiple times, the new effective date is coming up quick. Nonpublic entities should apply the new standard for fiscal years beginning after December 15, 2021, and interim periods within fiscal years...

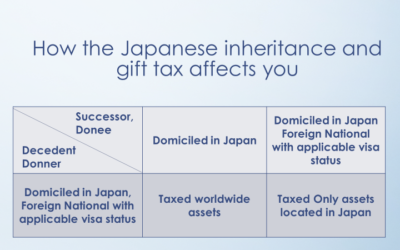

How do the new change of the Japanese inheritance and gift tax help you?

Aug 11, 2021 | Uncategorized

By Koh Fujimoto Support cross-border life Do you plan to move to Japan for your retirement with your Japanese spouse? There are, in fact, many couples who want to move to Japan. Many think of high-quality medical service and low-cost medical and long-term care...

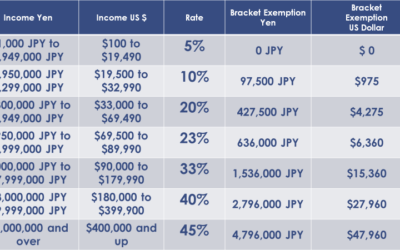

Is Japan a Good Country From Tax Rates Standpoint to Retire with Your Japanese Spouse?

Aug 16, 2021 | Uncategorized

By Koh Fujimoto Support cross-border life 1, Income Tax Rates: I made this chart using the exchange rate of $1 equals 100 JPY. This is the tax rate table for the Japanese income tax rates. There is another important tax that you cannot forget besides the income...

Protecting Company Profitability in Uncertain Economic Times

Aug 16, 2021 | Uncategorized

The pandemic has put extreme pressures on many businesses, and protecting profitability is of vital concern. The jury is still out on long-term inflation, but for now, we must deal with escalating material costs and shortages as well. Lumber, steel,...

Join Our Newsletter