News & Blogs

CDH NewsTransfer Pricing in the United States

Oct 19, 2023 | Uncategorized

Overview The Internal Revenue Service (IRS) governs transfer pricing regulations in the United States. The IRS has issued guidelines and regulations to ensure that multinational companies adhere to the arm's length principle and comply with the regulations outlined in...

International Estate Planning for Cross Border Families

Oct 23, 2023 | Uncategorized

Supports Cross Border Professionals and Families Today, you can work anywhere, and you can retire at any place in the world. Thanks to globalization and the advancement of technology, more and more people cross the boundaries of countries to have new lifestyles. For...

CDH, P.C. Welcomes Bernie Lietz as new COO

Oct 27, 2023 | Uncategorized

CDH, P.C. is pleased to announce and welcome back Bernie Lietz as its new Chief Operating Officer, effective October 23, 2023. Bernie was with CDH from 2005-2014 and served as both our firm administrator and COO. "We are so excited to welcome Bernie back to CDH! He...

Lorean Sneed Set To Retire After 11 Years With CDH!

Nov 13, 2023 | Uncategorized

Lorean Sneed will be retiring effective December 1, 2023. Lorean has been a crucial member of our team for the past 11 years. On behalf of CDH, P.C. We thank her for all her contributions and wish her nothing but the best in her new journey. Lorean joined CDH in...

Hikaru (Koh) Fujimoto Set To Retire After 25+ Years With CDH

Nov 27, 2023 | Uncategorized

It is with mixed feelings that we are announcing that Hikaru “Koh” Fujimoto is retiring from CDH, P.C. on December 31 and ready to fully embrace his next adventure. Koh has been part of CDH for more than 26 years, and during that time, he initiated and grew our...

Abandoning Green Card Illustration

Nov 27, 2023 | Uncategorized

Supports Cross Border Professionals and Families This article will explain the three critical steps in abandoning a green card for U.S. tax purposes. Preparation Step Preparation is the most critical step in abandoning a Green Card. You need to ensure that your U.S....

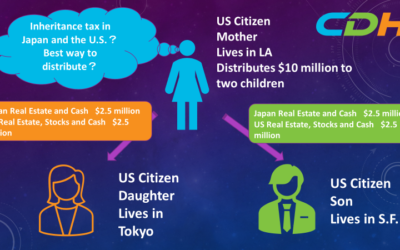

Cross Border Inheritance Case Study

Jan 2, 2024 | Uncategorized

By Koh Fujimoto Support Cross-Border Life Cross Border Inheritance gives headaches even to professionals. My mission is to explain the essence of the matter in plain English. I consider the U.S. federal tax only here in this article. Case A U.S. citizen mother has two...

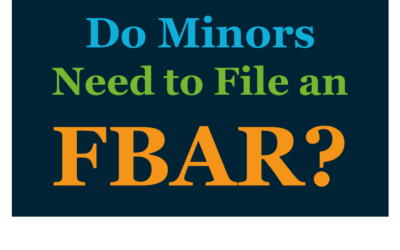

Do minors need to file an FBAR to disclose their accounts outside the U.S.?

Jan 23, 2024 | Uncategorized

The U.S. Foreign Bank and Financial Accounts Report (FBAR) program requires U.S. citizens and residents (for U.S. tax purposes) to report accounts held at foreign financial institutions if certain criteria are met. It should be noted that the FBAR regulations also...

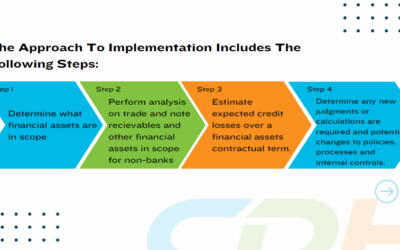

CECL Implementation: A Practical Approach

Jan 24, 2024 | Uncategorized

CECL stands for Current Expected Credit Loss, and it refers to a new accounting standard introduced by the Financial Accounting Standards Board (FASB) for estimating credit losses on financial instruments. While banks and financial entities will be most impacted by...

The Crucial Vote on 2023 Tax Return’s Child Tax Credit Expansion

Feb 1, 2024 | Uncategorized

This week, a bill to expand the Child Tax Credit is expected to be passed, which may be of interest to families with children. Fiscal year 2023 tax returns began being accepted on January 29th. The Child Tax Credit is one of the arguments for H.R. 7024 (Tax...

Navigating Your First Tax Return as an International Married Couple: Choosing the Right Filing Status

Feb 20, 2024 | Uncategorized

As the tax season rolls around in April, many newlyweds find themselves navigating the complexities of filing their first tax return together. This is particularly true for international couples, such as Hana, a green card holder from her marriage to an American...

Tax Day 2024: Navigating the Fiscal Landscape

Mar 13, 2024 | Uncategorized

As April 15th approaches, citizens across the United States are gearing up for Tax Day 2024. This annual deadline marks the final day for individuals to file their federal income tax returns with the Internal Revenue Service (IRS). However, Tax Day this year...

2024 Update: Essential Guide to International Inheritance for U.S. Residents

Apr 3, 2024 | Uncategorized

This article is written with Cross-Border persons in mind, especially Japanese nationals who are U.S. green card holders, but there are some points of reference for U.S. green card holders who receive their heritage from their home country. U.S. permanent...

Announcement: CDH, P.C. is Now CDH CPA, PLLC

Jun 12, 2024 | Uncategorized

We are excited to announce that effective July 1, 2024, CDH, P.C. will be changing its name to CDH CPA, PLLC. Please note that while our name is changing, our commitment to you remains the same. The only significant changes you will notice are: 1.The company...

Navigating the Updated Employee Retention Credit for Taxes

Jan 28, 2021 | Blog, COVID-19 Resources, Tax Services

The Consolidated Appropriations (CCA) Act of 2021, signed into law on December 27, 2020, changes the employee retention credit. Some of the changes retroactively modify the Coronavirus Aid, Relief, and Economic Security (CARES) Act, while others are prospective...

American Rescue Plan Act and How it Impacts Businesses

Mar 24, 2021 | Blog, COVID-19 Resources, Tax Services

On March 11, Congress instituted the latest Coronavirus (COVID-19) relief fund, the American Rescue Plan Act of 2021. This plan includes a total of $6 trillion in economic relief. Many plan provisions provide aid if...

Coronavirus Small Business Relief Update

Jan 11, 2021 | Blog, COVID-19 Resources

Second Draw Payroll Protection Program Loans and First Draw Forgiveness Businesses continue to face unprecedented economic hardship due to the Coronavirus (COVID-19) outbreak. To assist, the Coronavirus Aid, Relief and Economic Security (CARES) Act has provided...

IRS Rulings on Paycheck Protection Program and Its Tax Impacts

Dec 4, 2020 | Blog, COVID-19 Resources

The recent IRS rulings of Revenue Procedure 2020-21 and Revenue Ruling 2020-27 may impact businesses' ability to deduct the funds given under the Paycheck Protection Program (PPP), provided to create relief during the pandemic.On November 18, the IRS remarked the...

Sage Intacct: Accomplishing What QuickBooks Can’t

Nov 18, 2020 | Sage Intacct, Tech Blog, Technology Solutions

When companies decide to leave QuickBooks, few people object. Have you reached the expiration date on your accounting software?

The Paperless Office: A New Priority for Healthcare Finance Units

Jan 21, 2021 | Sage Intacct, Tech Blog, Technology Solutions

The coronavirus pandemic has been hard for healthcare finance teams trying to exchange paper documents while working remotely. Here’s the simple solution.

Join Our Newsletter