Support cross-border life

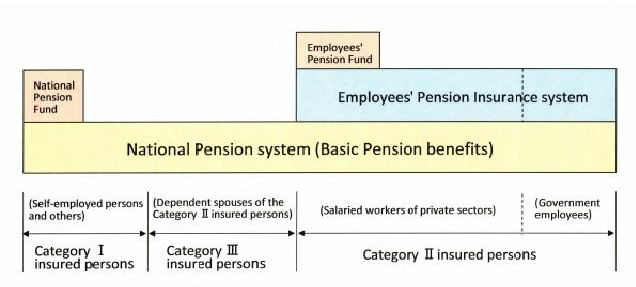

This chart is on the website of the Japan Pension Service. [i] In this article, I want t to explain why the WEP provision of the Social Security system should not reduce your U. S. Social Security benefits simply because you are receiving the National Pension (“Kokumin Nenkin”) from Japan.

Windfall Elimination Provision(“WEP”) is a provision that changes the way your U.S. social security benefits are calculated. WEP can reduce your U.S. retirement or disability benefits if you receive a pension based on work and you did not pay U.S. Social Security taxes on those earnings. [ii] Many foreign pensions fall into this category.

However, the National Pension is not based on work; and instead, it is based on your residency in Japan. [iii]: All people registered to reside in Japan and aged between 20 and 59, irrespective of their nationality, must be covered by the National Pension system and pay contributions by law. [iv] Thus, theoretically, the National Pension benefits should not reduce your U.S. social security benefits because it is not based on your work in Japan.

In reality, the U.S. Social Security Administration does not recognize this logic and continues to reduce your U.S. social security benefits if you receive the National Pension. At the same time, the U.S. Social Security Administration lists seven foreign pensions similar to the National Pension as not subject to WEP. In addition, the U.S. Social Security Administration settled the case with a plaintiff about the pension received from the National Institute of Israel. The plaintiff successfully argued that their pension system should not trigger the WEP in court.

The U.S. social security system either sends you a questionnaire to verify if you receive a foreign pension that was not subject to the U.S. social security taxes or asks the same question at an interview on-site of their office. If they find out that you are receiving the foreign pension, they will re-calculate your U.S. social security benefits. The amount of one’s reduction could reach up to almost $500 a month.

In many instances, you will find that the reduction calculation is wrong, and you need to contact the U.S. Social Security office. You have sixty-five (65) days to appeal to their determination. If you need help appealing to the U.S. Social Security office, please feel free to contact me. I will do my best to help you appeal to the U.S. Social Security office as I belong to the Nenkin Support Center of America. https://nenkinsupportcenter.org/ Our mission is to remove Japan’s National Pension from the WEP provision.

CDH provides tax filing services for individuals living in the U.S. and strives to resolve and explain their various problems and questions every day. In addition, these people’s issues are complex and wide-ranging, including U.S. and Japanese tax laws, immigration laws, life insurance, and retirement rules. I intended to make this article as easy as possible to understand the points of complex tax laws and regulations. So there are many exceptions. If you take action, be sure to consult with a tax and legal professional.

I produce Japanese videos with the same topic on YouTube. Would you please search at CDH 会計事務所? We also offer free consultations. Would you please make a reservation from this link? If you have any questions by e-mail, we will meet you and answer them. https://outlook.office365.com/owa/calendar/[email protected]/bookings/

If you would like to subscribe to CDH’s newsletter, please visit https://www.cdhcpa.com/login/

[i] https://www.nenkin.go.jp/international/japanese-system/nationalpension/nationalpension.html

[ii] https://www.ssa.gov/international/wep_intro.html#:~:text=The%20Windfall%20Elimination%20Provision%20(WEP,Security%20taxes%20on%20those%20earnings.

[iii] https://www.nenkin.go.jp/service/pamphlet/kaigai/kokunenseido.files/2English.pdf

[iv] Same as above