Supports Cross Border Professionals and Families

There are three tax benefits for foreigners moving to Japan. Since the author of this article is not a licensed Japanese tax accountant, this article does not contain any tax advice. The author is a U.S. CPA licensee.

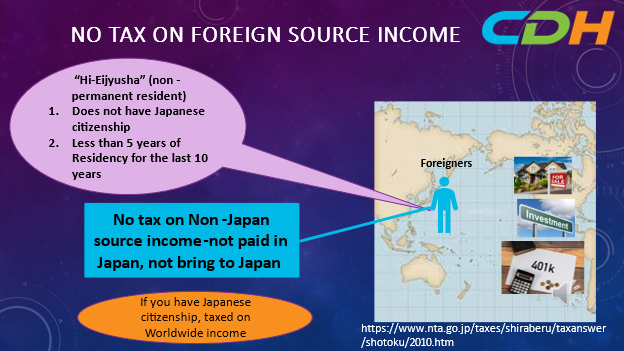

- No tax on foreign source income

If you are “Hi-Eijyushya” (non-permanent resident) under the Japanese tax regulations, the government does not tax your foreign source income as long as you do not bring it to Japan. To qualify as Hi-Eijyusya, you must have less than five years of tax residency for the last ten years. Bringing the income to Japan includes “getting paid in Japan” and “using foreign credit cards.” You can find the details of the rule on this website. https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/2010.htm

- Exempt from the foreign assets reporting and exit taxes

If you also are “Hi-Eijyusya,” you do not have to report your foreign assets even if your foreign assets are over 50 million yen (approximately $355,000) at the end of the year. Unlike the U.S. FBAR rules, the assets subject to reporting include real estate and non-financial account assets. https://www.nta.go.jp/taxes/shiraberu/taxanswer/hotei/7456.htm

You are also exempt from the Japanese exit taxes. The Japanese government taxes unrealized gains on securities and other specified assets if such assets exceed 100 million yen (approximately $710,000). The assets subject to taxation include your US pensions and real estate holdings. The U.S. exit tax has a similar provision called Mark to Market tax as a part of the exit tax system. The Japanese rule covers a wider variety of assets. We should note that there is no exemption. https://www.nta.go.jp/taxes/shiraberu/shinkoku/kokugai/pdf/03.pdf

As a Japanese citizen, you are subject to the rules from the day you pick up the Japanese tax residency.

- Gift and Inheritance tax breaks

If you live in Japan with certain residence status, the Japanese government will not tax your foreign assets. This area of rules is very complex because the tax will differ based on your and the other person’s status; you must consult an international tax accountant with a Japanese tax license. CDH can refer you to such an accountant. The general rule is that the status on Beppyo 1 exempts you from getting taxed on non-Japanese assets.

https://www.moj.go.jp/isa/applications/guide/qaq5.html?hl=en

https://www.moj.go.jp/content/000116415.pdf

You can find this Japanese table as your next learning step further to understand Japan’s gift and inheritance tax laws. https://www.nta.go.jp/taxes/shiraberu/taxanswer/zoyo/4432.htm

With today’s exchange rates, many want to retire in Japan. I hope this article will be the first step for your research on the Japanese taxation on foreigners moving to Japan.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please get in touch with us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, FaceBook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]