Supports Cross Border Professionals and Families

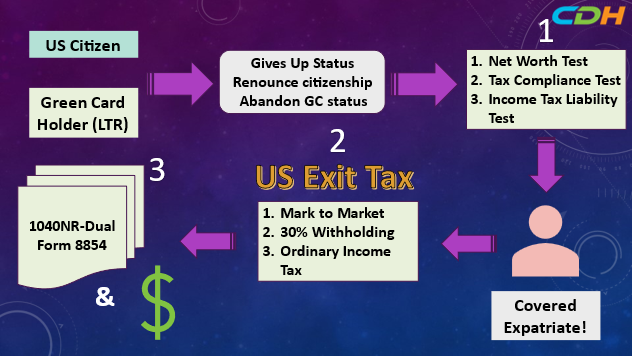

This article aims to give you a broad view of the US exit tax. Many UC citizens and Green Card Holders consider giving up their status and moving to other countries. The US government established a system where such individuals may get taxed. Please see the diagram below when you read my article.

- Who is subject to the U.S. exit tax?

You may be subject to taxes if you meet at least one of the following three tests when abandoning your status. They are:

- Net Worth Test – if your net worth equals or exceeds $2,000,000 on the expiration date, you pass the test. This is an individual basis test, and each spouse must value his/her assets separately. There are rules on how to divide jointly owned properties. There are no clear guidelines for the expiration date for green card holders. One of the accepted dates is when the holder notifies the USCIS of the intention of the abandonment by sending Form I-407.

- Income tax compliance test -you fail to certify on Form 8854 that you have complied with all U.S. federal tax obligations for the five years preceding the date of your expatriation. You generally cannot certify compliance if you fail to report foreign financial accounts in FBAR and other international reporting forms.

- Income Tax Liability test – your average annual net income tax for the five years is more than $190,000 for 2023. Please note that this is your federal income tax liability amount. When you file an MFJ return, each spouse must pick up 100 percent of the tax liability.

If any of the three apply, you are a “covered expatriate.” If none of these apply, you do not pay any exit tax.

Not all the green card holders must go through these tests. If you are a Long-term resident (LTR), you do not have to. You are an LTR if you were a lawful permanent resident of the United States in at least 8 of the last 15 years ending with the year you are no longer treated as a lawful permanent resident.

- How the IRS taxes you

The IRS has three ways to tax you based on the asset types.

- Mark to Market Tax

Most assets are subject to this capital gain tax on unrealized capital gains. All property except the ones mentioned in (2) and (3) below is deemed sold for its fair market value day before the abandonment day. The IRS, luckily, gives you the tax exclusion ($821,000 for 2023), and any unrealized gains over this exclusion are subject to capital gain taxes. Capital gain tax rates will apply. If there are no capital gains, no mark-to-market taxes are levied.

- 30% Withholding from Distributions from Eligible Deferred Compensation Items

- If the payor is a U.S. person or a non-U.S. person who elects to be treated as a U.S. person and (b) a covered expatriate submits W-8CE form on time, the payor must deduct 30 percent of any taxable payment to a covered expatriate. No upfront taxes are required to be paid. A typical example of deferred compensation is a U.S. 401(k) plan or a U.S. company pension.

- Ineligible Deferred Compensation items and Specified Tax Accounts

All other deferred compensation other than an eligible deferred compensation item are ineligible deferred compensation items. If you have any ineligible deferred compensation items, you must submit W-8CE on time. The payor of the item must advise you of the present value of the deferred compensation. Such an amount is treated as being received by the covered expatriate on the day before the expiration date as a distribution. An IRA account is a typical example of a Specified Tax Account. The covered expatriate must submit W-8CE to the custodian, and the custodian must advise the covered expatriate of the amount of the entire interest in the account on the day before the expiration date. The covered expatriate must include such an amount in his/her gross income.

- Tax Filing and Tax Payment

The covered expatriate must file Form 1040 NR-Dual Status returns and Form 8854 the following year to report the expiration year to the IRS. Form 8854 is called the initial and annual expatriation statement. The covered expatriates must pay taxes if they owe any exit and regular income taxes. In addition, he or she must file Form 8854 (a) if you defer the payment of tax for mark-to-market tax in a previous year, (b) reported an eligible deferred compensation item on a Form 8854 in a previous year, or (c) reported an interest in a non-grantor trust on a Form 8854 in a previous year.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, Facebook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]