Supports Cross Border Professionals and Families

This article summarizes three ways to get taxed under the US exit tax system. Please note that not all the covered expatriates become subject to taxation.

- Mark to Market

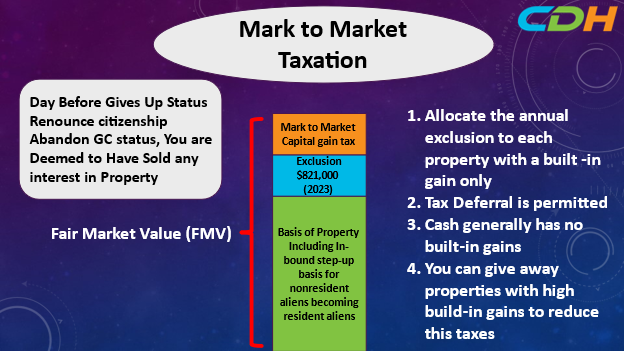

You are deemed to have sold any interest in your property the day before you give up your status as a US citizen or Long-Term Green Card Holder (“LTR”). You forecast the proceed from that deemed sale. The proceeds should represent the fair market value of your property. In essence, this is a capital gain tax on your unrealized gains. Please note that the assets mentioned later in this article in 2 and 3 are excluded from this exercise.

Any property you have should have a basis. The word “basis” is a tax term. In most cases, the basis means the cost or purchase price. As for properties being used for profit, generation should have ongoing depreciation, and the cost of these items should be lower than the purchase price.

An LTR can also use the Inbound step-up basis for nonresident aliens becoming resident aliens. One can use the higher of the two figures. They are the fair market value when becoming a resident alien and the basis of the property.

The IRS gives a break in the form of gain exclusion. The 2023 exclusion amount is $821,000. The amount is going to change based on the Chained CPI. Any unrealized gains above the exclusion are subject to the US exit tax with regular capital gain rates.

There are three noted points in the Mark to Market tax system:

- Allocate the annual exclusion amount on a pro-rata basis to the properties with building gains and exclude the properties with losses.

- You can elect to defer payment of taxes by posting a security.

- Cash generally has no built-in gains.

- Eligible Deferred Compensation Items (30% withholding)

Deferred compensation items generally represent 401(k), corporate pension, and other deferred compensation items such as RSU. To be an eligible deferred compensation item, (1) the payor must be either a U.S. person or a non-U.S. person who elects to be treated as a U.S. person, and (2) The covered expatriate must notify the payor of one’s status as a covered expatriate and irrevocably waives any right to claim any withholding reduction under any treaty with the United States.

Form W-8 CE (Notice of Expatriation and Waiver of Treaty Benefits) is the form a covered expatriate uses to notify. The covered expatriate must submit the form to the financial institutions before the deadline to receive this treatment.

When the covered expatriate takes distributions from the eligible deferred compensation, the amount becomes subject to 30% withholding. Thus, one can avoid immediate taxation at the time of exit.

I exclude the discussion about the distribution from a non-grantor trust in this article. Such distribution is also subject to this rule of 30% withholding.

- Immediate Taxation of the US Exit Tax

- Ineligible Deferred Compensation Items.

Any deferred compensation items except eligible deferred compensation items become ineligible deferred compensation items. An amount equal to the present value of the covered expatriate’s accrued benefit is treated as having been received by the covered expatriate on the day before the expatriation date. The covered expatriate must also submit W-8 CE to the financial institutions to obtain the value of the benefits.

- Specified Tax Deferred Accounts

They are IRAs, Health Saving Accounts, and Section 529 Educational Saving Accounts. A covered expatriate is treated as having received a distribution of one’s interest in such an account on the day before the expatriation date. One also must submit a W-8CE to obtain the figures of the entire interest.

- Final Comments

I recommend any future covered expatriates review one’s potential taxation and devise a plan to minimize the U.S. exit taxes. It takes planning to cover at least a few years before expatriation.

CDH provides tax return preparation and tax consulting services for cross-border individuals living in the United States or foreign countries and strives every day to solve and explain various problems and questions of these people. In addition, the issues these people face are complex and wide-ranging, including the tax laws of your country and the United States, immigration law, life insurance, and retirement rules. This article makes complex tax laws and regulations easy to understand, which is just the point. Therefore, there are many exceptions. There is also a risk that the rules have already changed by reading them. Please contact us from the following website for the latest practices. Also, consult with tax and legal affairs experts if you take action.

CDH Resources: www.cdhcpa.com. We provide one-hour paid consultation sessions online. https://outlook.office365.com/owa/calendar/[email protected]/bookings/ If you can read Japanese, visit https://www.cdhcpa.com/ja/cross-border-individual-tax/. You can access them all on the page. YouTube, Facebook, free online consultations, estate, permanent resident waiver, exit tax, Form 1040, tax simulation, overseas asset reporting, other sectoral online question forms, and monthly newsletter sign-ups. For more information-packed past articles, check out https://www.cdhcpa.com/ja/news/. Please feel free to use it. You can email me at [email protected]